or call: +1 (845) 347-8894

or call: +1 (845) 347-8894

or call: +1 (845) 347-8894

Great supplier relationships bring great competitive advantage. Strong relationships with vendors often depend on the speed at which you, as an accountant, release their payments. And while the invoice processing time is the most crucial here, it is also noticed that this is precisely the biggest challenge most businesses face.

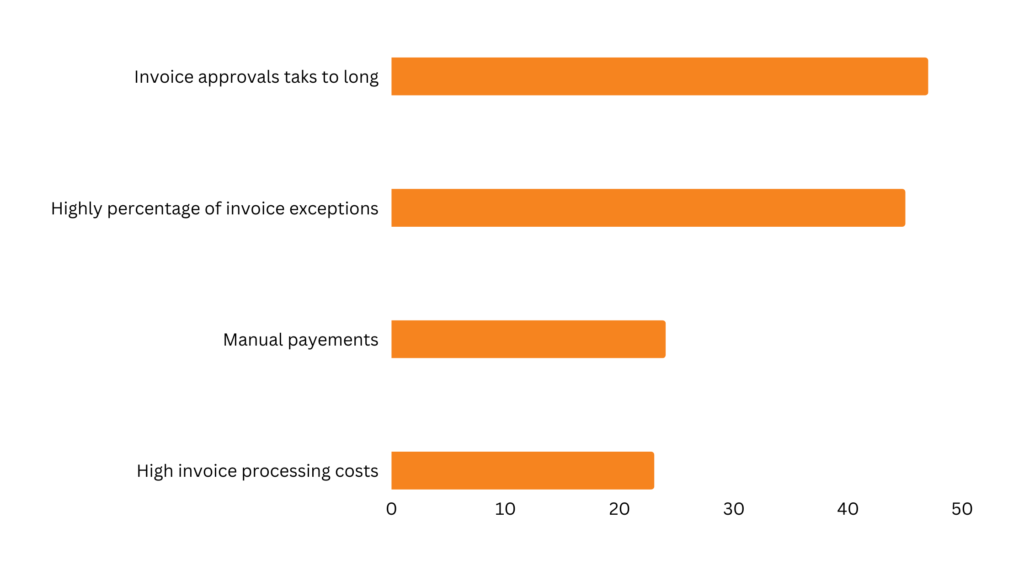

Almost 45% of businesses suggest that their accounting departments struggle with extended invoice processing times due to complicated workflows. This means more late payments and penalties—all of which can lead to costlier goods or services from suppliers down the line.

According to Gartner, if processing payment for invoices takes more than seven days and less than 50% of that process is digitized, automation can help remove inefficiencies.

Using Gartner’s Market Guide for Accounts Payable Invoice Automation Solutions, we put together this blog to help small and midsize business (SMB) owners break away from labor-intensive invoicing processes and improve accuracy across their accounting functions.

An Arizona-based entrepreneur, Lindsey Hyland, shares that automating invoice processing created an efficient workflow, cut down labor hours, and spared them more time to focus on valuable tasks.

Invoice processing means handling incoming invoices or bills from suppliers and processing payments for them. Accounts payable (AP) teams in accounting usually manage the entire lifecycle of supplier invoices, from arrival to payment, ensuring that goods or services have been received and are backed by appropriate orders before authorizing invoice payments. All of this helps maintain positive relationships with suppliers.

Businesses can take over 11 days and $10.20 per invoice in manual invoice processing. Typically, the process involves five steps (demonstrated below), which can stretch up to 15 in case of discrepancies in amount or quantity.

These efforts can be reduced by automating many areas of invoicing, such as matching the invoice with the purchase order or detecting duplicate invoices.

Many problems plague AP teams in invoice management. They include but are not limited to:

With automated invoice processing, you eliminate piles of paperwork and reduce the likelihood of missing invoices. The most prominent benefits of invoice processing automation include:

Accounts payable (AP) software solutions are evolving to become more and more sophisticated. They are incorporating technologies such as optical character recognition (OCR), machine learning (ML), and artificial intelligence (AI) to automate entire invoice capture-to-pay processes.

Gartner research shows that payment automation is often the main reason small businesses look for invoice automation solutions, while midsize organizations may require more functionalities, such as easy data capture for an increased volume of invoices and improved supplier coordination. Start by automating tasks that consume the most time and resources at your organization. From invoice data capture to handling payments and generating reports, here are some invoice processes that can be automated with these solutions:

When finding an AP automation tool to process invoices, you should look for a system that is easy to use, integrates with other systems, and has robust reporting capabilities.

Use these tips to see if automation is right for your business and what you should look for in accounts payable software:

Source: Software Advice